Come Visit us at our new site at http://donedam.com

April 14, 2008

Stylish Fire Safety for Your Home

Posted by dredam under Design, Gift Ideas, Misc, TipsLeave a Comment

Back in 2005 came the introduction of SnapAlarm, an award-winning optical smoke detector from FireInvent, and now the same Swedish company is taking fire protection a step further with its all-in-one Fire Safety Box.

The Safety Box is designed to provide complete fire protection in a single package, and it comes in six different versions tailored to different usage contexts. But the fire extinguishers, smoke detectors, fire blankets and torchlights included aren’t just ordinary versions of those items. Rather, they have been revamped for a modern, attractive look. The Safety Box Design, for example, includes fire extinguisher and Snap Alarm in black or white; black-and-white fire blanket in a modern, botanical design; plus an extra wall-mountable optical smoke detector. The Safety Box Exclusive, meanwhile, includes a chrome option for the fire extinguisher, while the Safety Box Kid includes a Snap Alarm in pink or blue and a fire blanket suitable for children. Pricing begins at $185 and versions for cars and boats are also available.

There will always be a need for functional products like fire protection devices, but there’s nothing to say they can’t be upgraded with a splash of color and design and sold at a similarly upgraded price.

March 23, 2008

Happy Easter from The Don Edam Group!

Posted by agentkelly under Events, For Fun, MiscLeave a Comment

Happy Easter, Happy House Hunting, and Speedy Spring Sales to all of our clients, friends, and family from all of us here at The Don Edam Group!!!

March 19, 2008

Minnesota Green: How to Save Our Environment One Reusable Envelope at a Time

Posted by agentkelly under Design, Green Living, Marketing, Misc, Tips | Tags: business, green, Marketing, Tips |Leave a Comment

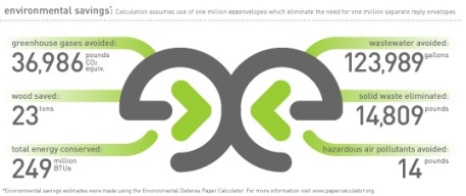

Minnesota is already known for being “nice”, but a local company called ecoEnvelopes is bringing nice to the world and attempting to turn corporate America green by helping businesses reduce their company’s environmental impact AND save money in the process.

After working for years to perfect the design and obtain the US Postal Service’s approval, ecoEnvelopes has developed an innovative line of reusable envelopes that simply zip open, allowing users to insert their response or payment and seal them up again just like a regular envelope. With 81 billion return envelopes being sent through the US mail each year, ecoEnvelopes stands to have a great impact on the environment by helping to reduce the estimated cost of envelope-excessive corporate America’s 1 billion pounds in greenhouse gas emissions and more than 71 trillion BTUs of energy.

Not only can everyone participate in environmental stewardship and feel good about their part in greening the mail (the envelopes are also made with up to 100% post-consumer recycled content!), but by eliminating the need to print, store, handle, insert, track and include a separate reply envelope, ecoEnvelopes can cut mail costs 15% to 45%, the company says.

Not a bad way to “green” our real estate businesses, I say! 🙂

March 10, 2008

New Contributor

Posted by dredam under Misc, News | Tags: Blog, new, The Don Edam Group |Leave a Comment

We’ve been quiet for a little while over here while we work on redesigning our blog and attempting to improve content. Helping me do that is our Marketing Manager, Kelly Carlson. Kelly will start to become a frequent contributor to this blog. I feel she’ll do a great job and should be able to comment on many things that I don’t have the expertise in. So, please welcome Kelly to the site!

Also, be on the lookout for a redesigned site in the next couple weeks. As always, you’re comments are greatly appreciated.

February 22, 2008

There’s really no sure way to avoid an audit. Most audited tax returns are selected for review either because the filer is part of a target group or because a computer program selects the return. The computer selects many returns randomly, but there are red flags that will draw the IRS’s attention.

The key is to minimize your exposure. Here are some suggestions from MSN Money on things you should try to avoid:

1. Math mistakes

The biggest reason people receive letters from the IRS is addition or subtraction goofs. Fortunately, math errors rarely lead to a full audit. Still, double-check your math before you send in your return.

And if you receive a letter from the IRS that says you owe them, check your numbers first. Sometimes, the IRS misreads one of your numbers, or the number is keyed incorrectly into the IRS computer. If it’s wrong, send a letter with a printout of your calculations.

2. Mismatched interest and dividend reporting

If the amounts reported in supporting documents don’t match the amounts on your return, you will get a letter.

There are lots of possible errors here. Sometimes, the IRS will enter the Form 1099 information into its computer and erroneously keystroke the income amount or the Social Security number of the recipient. If the income isn’t yours, get a letter from the bank or other payer and forward that letter to the IRS. If the amount is incorrect, send a copy of the Form 1099 mailed to you by the payer.

3. You’re on the IRS hit list

Those who receive much of their income in cash are traditionally on the radar screen of IRS agents looking for unreported income. Recently, the IRS has also pinpointed small-business owners and the self-employed in its bid to find more of the estimated $345 billion in uncollected taxes.

4. You’ve got a big mouth

Never brag about how you put one over on the IRS. Internal Revenue Service informers can earn a reward of between 15% and 20% of the additional tax collected, including fines and penalties and interest. Whistleblowers can file Form 211 or call the IRS hotline at 1-800-829-0433. Everyone else: Zip it, and keep your accounting strategies to yourself.

5. You’re exceptional

An IRS computer program compares your deductions to others in your income bracket and weighs the differences. This secret IRS formula, called the “DIF Score,” is used to select returns with the highest probability of generating additional audit revenue.

The IRS is coming

If you are facing an audit, don’t panic. An audit is merely a process where the IRS asks you to substantiate the numbers on your tax return. Here are some survival strategies:

Call your tax professional. Or get one. If the audit is simple – to prove your charitable and interest deductions, for example – you can do it yourself by mailing in copies of your substantiation. For all in-person audits, I strongly suggest professional representation.

Plan your taxes to preempt an audit. If, say, you have a huge medical deduction that you feel would increase your chances of being audited, attach copies of your medical bills to your return. The IRS computer will still kick out your return, but when a real person looks at it, the reviewer will recognize that you know the rules. This may actually reduce your odds of a full audit.

Keep records for three years. The IRS can audit you for three years after you file your return. In reality, however, most returns are audited within 18 months. This gives the IRS time to do the review and request the appropriate substantiation before the statute of limitations (usually the three-year period) ends.

Once the deadline has passed, the IRS normally cannot audit your return and your expenses are insulated from examination.

File at the last minute if you are concerned about a potential audit. It won’t hurt and might decrease your chances of being selected. The good news is, if you are audited one year with a refund or no change, it decreases your odds of being audited in subsequent years. In fact, if you are audited on the same items two years in a row with no additional taxes due, the IRS manual specifically recommends that they not audit you on the same items for a third year. Full Story

February 22, 2008

Foreclosure Filings Report: Hardest Hit Markets by State

Posted by dredam under Finances, Foreclosure, Mortgages, News, TrendsLeave a Comment

U.S foreclosure filings continued their upward climb in December, rising 97% from the previous year and 7% from the month before. Total foreclosures rose 75% in all of 2007.

According to MSN Real Estate’s latest report, hardest-hit markets were along both coasts, which experienced a more severe boom and bust in the latest cycle, as well as areas hard hit by auto-industry layoffs such as Michigan and Indiana.

The surge in foreclosures is expected to continue at this same pace until after the next wave of risky loans resets in the middle of 2008.

2007 foreclosure filings by state

|

Rate Rank |

State Name |

Total # of filings |

% chng. from 2006 |

% chng. from 2005 |

Total # of properties |

%Households |

|

1 |

Nevada |

66,316 |

215.12 |

758.68 |

34,417 |

3.376 |

|

2 |

Florida |

279,325 |

123.96 |

129.25 |

165,291 |

2.002 |

|

3 |

Michigan |

136,205 |

68.32 |

282.22 |

87,210 |

1.947 |

|

4 |

California |

481,392 |

237.99 |

681.95 |

249,513 |

1.921 |

|

5 |

Colorado |

71,149 |

29.96 |

140.12 |

39,403 |

1.919 |

|

6 |

Ohio |

153,196 |

87.93 |

207.35 |

89,979 |

1.797 |

|

7 |

Georgia |

99,578 |

31.07 |

118.43 |

59,057 |

1.566 |

|

8 |

Arizona |

69,970 |

150.91 |

160.7 |

38,568 |

1.516 |

|

9 |

Illinois |

90,782 |

25.29 |

94.3 |

64,310 |

1.25 |

|

10 |

Indiana |

52,930 |

11.31 |

73.57 |

27,980 |

1.027 |

|

11 |

Tennessee |

45,834 |

24.56 |

65.66 |

25,914 |

0.983 |

|

12 |

Texas |

149,703 |

-4.57 |

9.22 |

84,469 |

0.936 |

|

13 |

Missouri |

32,022 |

80.93 |

176.74 |

23,492 |

0.906 |

|

14 |

New Jersey |

53,652 |

34.06 |

52.75 |

31,071 |

0.902 |

|

15 |

Utah |

9,668 |

-25.87 |

-16.19 |

7,438 |

0.852 |

|

16 |

Connecticut |

23,470 |

100.05* |

111.38* |

11,860 |

0.833 |

|

17 |

Maryland |

25,109 |

455.26 |

388.41 |

18,879 |

0.83 |

|

18 |

North Carolina |

37,426 |

66.52 |

135.07 |

29,101 |

0.739 |

|

19 |

Mass. |

41,487 |

161.14 |

751.36 |

17,737 |

0.66 |

|

20 |

Idaho |

6,032 |

140.51* |

119.83* |

3,640 |

0.611 |

|

21 |

Washington |

23,705 |

27.95 |

59.47 |

15,184 |

0.573 |

|

22 |

Oregon |

10,746 |

12.25 |

56.76 |

8,461 |

0.543 |

|

23 |

Oklahoma |

13,594 |

-12.78 |

0.71 |

8,256 |

0.52 |

|

24 |

Virginia |

24,199 |

456.3 |

728.73 |

16,307 |

0.514 |

|

25 |

Minnesota |

13,615 |

127.11* |

506.73* |

11,557 |

0.513 |

|

26 |

Arkansas |

14,310 |

26.44 |

23.58 |

6,406 |

0.513 |

|

27 |

New York |

57,350 |

10.19 |

54.72 |

38,688 |

0.493 |

|

28 |

Alaska |

1,650 |

54.64 |

17.69 |

1,332 |

0.486 |

|

29 |

Wisconsin |

17,503 |

131.15* |

241.79* |

12,133 |

0.486 |

|

30 |

Nebraska |

3,971 |

30.88 |

91.84 |

3,636 |

0.474 |

|

31 |

Rhode Island |

3,241 |

153.80* |

7804.88* |

1,838 |

0.41 |

|

32 |

New Mexico |

3,893 |

-26.04 |

-46.55 |

2,994 |

0.357 |

|

33 |

Iowa |

7,404 |

114.92* |

251.90* |

4,103 |

0.314 |

|

34 |

Pennsylvania |

34,089 |

-11.07 |

18.98 |

16,379 |

0.302 |

|

35 |

Kentucky |

8,793 |

23.45 |

76.96 |

5,105 |

0.274 |

|

36 |

Montana |

1,378 |

29.27 |

52.6 |

1,150 |

0.268 |

|

37 |

Alabama |

7,903 |

81.76 |

83.07 |

5,572 |

0.268 |

|

38 |

Delaware |

1,430 |

225.00* |

342.72* |

999 |

0.266 |

|

39 |

South Carolina |

5,038 |

-27.56 |

-33.76 |

4,247 |

0.22 |

|

40 |

New Hampshire |

N/A |

N/A |

N/A |

1,238 |

0.212 |

|

41 |

Louisiana |

7,331 |

151.58* |

90.61 |

3,968 |

0.204 |

|

42 |

Kansas |

4,978 |

20.85 |

161.31* |

2,434 |

0.203 |

|

43 |

Hawaii |

1,270 |

88.71 |

-60.39 |

966 |

0.197 |

|

44 |

Wyoming |

497 |

21.52 |

99.6 |

356 |

0.151 |

|

45 |

Mississippi |

1,997 |

91.65 |

4.55 |

1,409 |

0.114 |

|

46 |

North Dakota |

308 |

74.01 |

86.67 |

250 |

0.082 |

|

47 |

West Virginia |

1,135 |

30.31 |

10.95 |

460 |

0.053 |

|

48 |

Maine |

N/A |

N/A |

N/A |

286 |

0.042 |

|

49 |

Vermont |

61 |

35.56 |

1.67 |

29 |

0.009 |

|

50 |

South Dakota |

N/A |

N/A |

N/A |

24 |

0.007 |

| District of Columbia |

800 |

607.96* |

393.83* |

777 |

0.28 |

|

|

— |

U.S. |

2,203,295 |

74.99 |

148.83 |

1,285,873 |

1.033 |

*Actual increase may not be as high due to improved or expanded data coverage in this state.